RIO Ready: Form 1098-T Document Generation Setup

Table of Contents

See also: Form 1098-T Document Generation Functionality

Prerequisite

- Ensure that the Form_1098_T package is installed. This can be indicated by the presence of:

- the custom setting US Tax Custom Settings

(object name: US_Tax_Custom_Settings)

- the custom object US Tax Receipt

(object name: redu_US_Tax_Receipts)

- the custom setting US Tax Custom Settings

- If the above are not found, please contact WDCi for further assistance.

Setting up the TDTM Triggers

- From the Developer Console, run the redu_TaxFormTriggerHandler_MANAGER.initCustomTriggerHandler().

Detailed Step:

This will require a user that has access to the Developer Console (typically an administrator), and they can do so by clicking on Setup (the gear icon on the top right) -> Developer Console.

This will open the Developer Console in a new window typically.

Then, once in Developer Console, open the Anonymous Window by selecting Debug (top menu) -> Open Execute Anonymous Window.

Clear or comment out any existing Apex Code in the Anonymous Window and finally type in

redu_TaxFormTriggerHandler_MANAGER.initCustomTriggerHandler();

and finally click 'Execute' to let Salesforce run our trigger installation script.

- Once the TDTM triggers setup above are done, we need to setup the US Tax Custom Settings to indicate the Tax Year and other required data.

For more information on this, please consult here on what each of the Custom Setting field controls, but at minimum, we must provide the Tax Year in the Custom Setting for basic calculations on 1098-T.

Generating the Tax Report

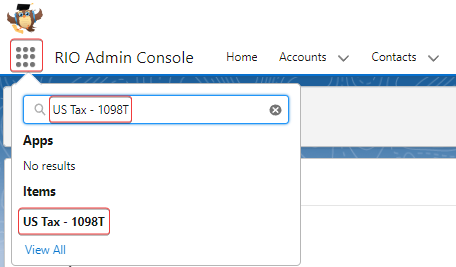

To generate the US Tax Receipt records, which are custom object records containing the calculated values for the fields in Form 1098-T, open the App menu and type US Tax - 1098T.

This will provide a link to the page for our custom component that will generate US Tax Receipts.

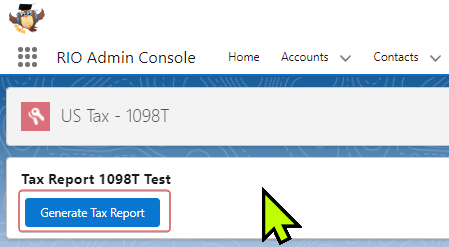

Then, in the component page, click on Generate Tax Report.

Creating the 1098-T Document

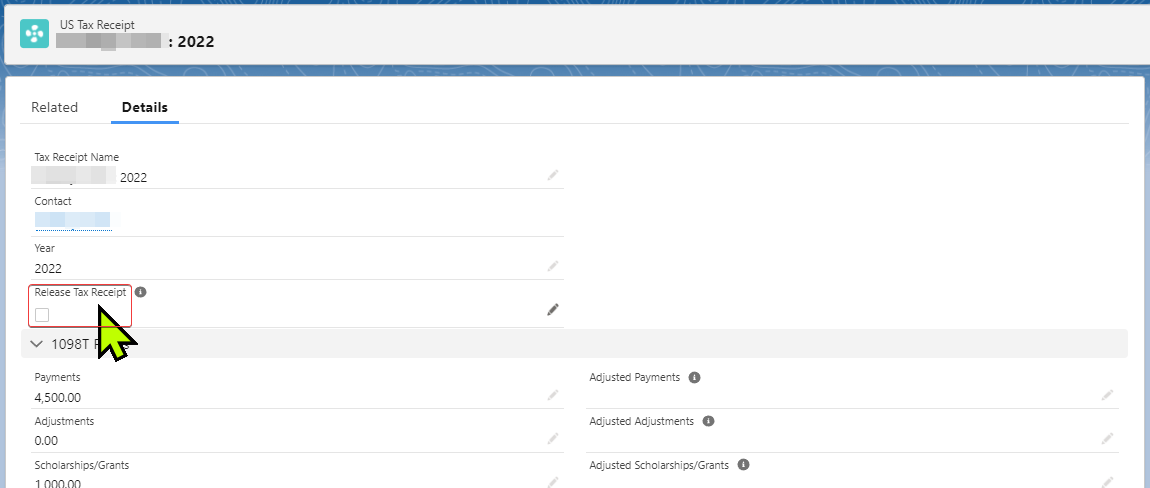

The US Tax Receipt record generated above contains the information needed to create Form 1098-T.

But to create an actual printable 1098-T form, we need to check a checkbox in the US Tax Receipt record called 'Release Tax Receipt'.

This will generate the PDF document attached to the US Tax Receipt record which can be set to be visible to the Student.

Note that the PDF document is generated using S-Docs.

In situations where a Student needs to access the document particularly through Student Community (a common approach used), then, additional work and automation will be required particularly to open the access for the document to the Student.

1098-T Custom Setting

Field label |

Field name |

Field type |

Other comments |

Tax Year |

Tax_Year |

Number |

Current Tax Year that is being reported on. Note: Updated annually. (Used in all Box calculations particularly to determine the eligibility against the Tax Year calculation specified by this field, it is used for Box 1, Box 4, Box 5, Box 6, Box 7, Box 8, Box 9 calculation.) |

Historical Tax Year |

Historical_Tax_Year |

Number |

Cut-off year established by the IRS limiting historical reporting. Note: Updated annually. (Used in similar function to Tax Year to determine viability of records, it is used for Box 4 and Box 6 calculation.) |

Refund Transaction Types |

Refund_Transaction_Types |

Text(255) |

Comma delimited list of Payment transaction types used when refunds or reimbursements are issued to a student. Used to determine Prior Year Payment Adjustments. (Used in calculation for Box 4 where it is used along others to determine if the Fee Payment have Transaction Type that is valid for Box 4 value summation.) |

FA Payment Sources |

FA_Payment_Sources |

Text(255) |

Comma delimited list of Payment sources used to issue scholarships and grants to students that meet the criteria established in Box 5 on the 1098T Instructions form.

rio_ed__Fee_Payment__c.rio_ed__Payment_Amount__c to rio_ed__Student_Fee__c.redu_FA_Funding_Amount__c The result above is then used to calculate rio_ed__PE_Pathway_Status__c.redu_Unmet_Need__c Note: The final result field in PE Pathway Status is not currently used in automation and thus is only serving to provide information for now. |

Future Academic Period Cut-off |

Future_Academic_Period_Cut_off |

Date |

Cut-off date established by the IRS limiting payments received for academic terms that begin in a future tax year. Note: Updated annually. (Used in calculation for Box 7. Only the Terms that have Start Date between the Tax Year and this field will be considered for Box 7.) |

Scholarship / Grant Payment Sources |

Scholarship_Grant_Payment_Sources__c |

Text(255) |

Comma delimited list of Payment sources used to issue scholarships and grants to students that meet the criteria established in Box 5 on the 1098T Instructions form. |